Make the right move with a moving loan

Check your rate in 5 minutes.

Get funds sent in as fast as 1 business day.²

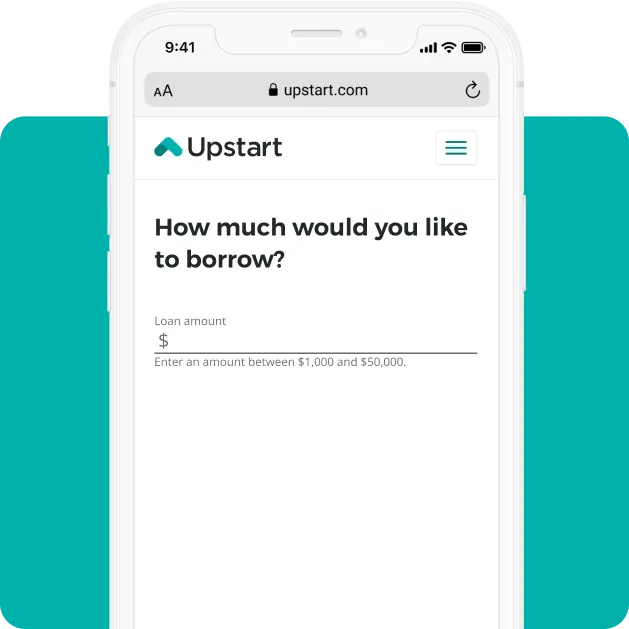

Apply for a loan from $1,000 to $75,000.³

Won't affect

your credit score¹Why choose Upstart for your moving loan?

A moving loan is a smart way to pay for a cross-country move or other moving costs such as truck rental, storage, and more.

A smarter loan

Our model consider factors beyond your credit score, like education⁴ and employment, to find you a rate you deserve.

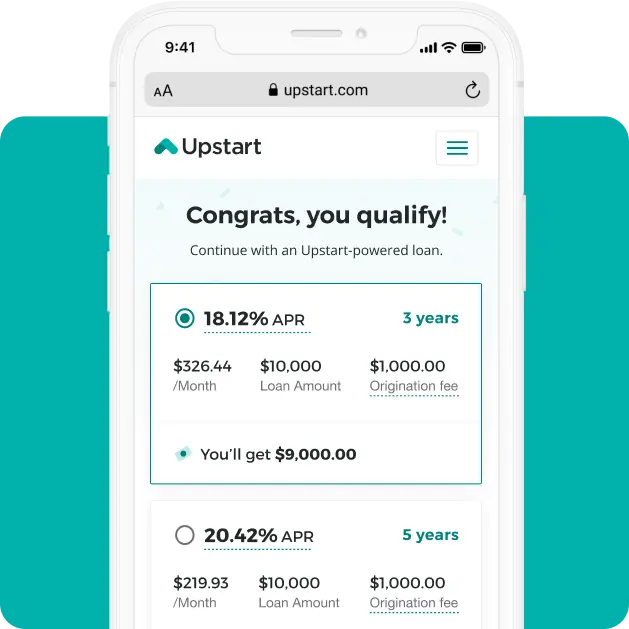

Fixed rates and terms

Review moving loan offers with 3 or 5 year terms, and fixed rates of 6.2% - 35.99% APR.⁵

No prepayment fees

You can pay off your loan early with no fee or penalty.

We've helped more than 4 million customers⁶

Ahmed paid down moving debt with a loan through Upstart⁷

"Upstart gave me the best rate by far and I really liked that they didn’t have a penalty for paying your loan off early."

How to apply for a moving loan online

Get your rate

It takes less than 5 minutes to check your rate—and it won’t affect your credit score.¹

Get approved

Find out if you're approved, instantly with no paperwork required.⁸

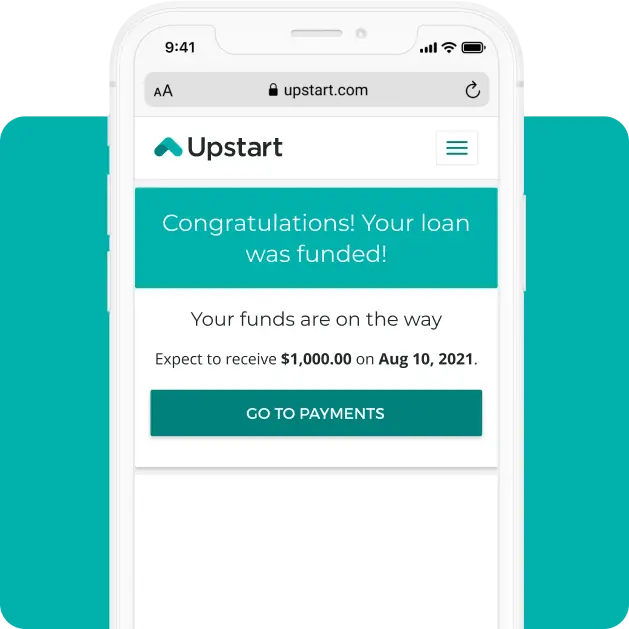

Get funds

Once approved, you could get funds sent in 24 hours or less.²

Won't affect

your credit score¹Moving loan FAQs

What is a moving loan?

A moving loan, also called a relocation loan, is a type of personal loan you can use to pay for moving costs. Most moving loans on our platform are unsecured, which means you aren’t required to back up your loan with collateral. There may be an option to secure your personal loan through Upstart with your vehicle, which will require a lien to be placed on the vehicle.What can I use a moving loan for?

You can use the funds from your moving loan for a variety of relocation costs, such as hiring movers, paying for security deposits, purchasing moving insurance, and covering hidden moving costs.How much can I borrow with a moving loan?

Our platform offers moving loan amounts between $1,000 and $75,000.³ It’s important to note that some states require specific minimum loan amounts. The exact amount you can borrow depends on what you qualify for based on your application information.Can I use a credit card for my moving expenses?

Yes, but since credit cards are a type of revolving credit, they can lead to overspending and high interest debt. Credit cards can be a good option if you’re able to pay off your balance in full each month.

Consider getting a moving loan since they’re more predictable. You’ll get a lump sum of money upfront, with a fixed interest rate. Once you get the funds, you can budget your monthly payments in advance.Should I take out a loan to move out?

A moving loan can be a good choice for you if you're unable to cover all of your moving costs. Before committing to a moving loan, remember that you have to pay back the funds plus interest, and there may be additional fees. Consider how much you’ll need to pay over the life of the loan before you sign on any dotted lines.What are the benefits of getting a moving loan through Upstart?

We take the time to consider more than your credit score to determine if you can qualify for a moving loan. Benefits include:

- Fast and seamless online application

- No prepayment penalty

- Fixed interest rates

- Predictable monthly payments

- Direct deposit for funds

Move forward with a moving loan

Won't affect

your credit score¹Other loan options

1. When you check your rate, we check your credit report. This initial (soft) inquiry will not affect your credit score. If you accept your rate and proceed with your application, we do another (hard) credit inquiry that will impact your credit score. If you take out a loan, repayment information may be reported to the credit bureaus.

2. If you accept your loan by 5pm EST (not including weekends or holidays), your funds will be sent on the next business day. When the funds will be available to you will depend on your bank’s transaction processing time and policies.

3. Your loan amount will be determined based on your credit, income, and certain other information provided in your loan application. Not all applicants will qualify for the full amount. Minimum loan amounts vary by state: GA ($3,100), HI ($1,500), MA ($7,000). Maximum loan amounts may vary by state.

4. Neither Upstart nor its bank partners have a minimum educational attainment requirement in order to be eligible for a loan.

5. The full range of available rates varies by state. The lowest rates are only available to the most qualified applicants. A representative example of payment terms for an unsecured Personal Loan is as follows: a borrower receives a loan of $10,000 for a term of 60 months, with an interest rate of 18.60% and a 7.82% origination fee of $782, for an APR of 22.69%. In this example, the borrower will receive $9,218 and will make 60 monthly payments of $259. APR is calculated based on 5-year rates offered in December 2025. There is no downpayment and no prepayment penalty. Your APR will be determined based on your credit, income, and certain other information provided in your loan application. Not all applicants will be approved.

6. As of 12/31/2025, across the entire Upstart marketplace.

7. Images are not actual customers, but their stories are real.

8. The majority of unsecured loan applicants on the Upstart marketplace are able to receive an instant decision upon submitting a completed application, without providing additional supporting documents, however final approval is conditioned upon passing the hard credit inquiry. Loan processing may be subject to longer wait times if additional documentation is required for review.

Upstart is not the lender. All loans on Upstart's marketplace are made by regulated financial institutions.